TradePlus Online Review:

In this article, I will be giving more detailed review of Tradeplus Online and its brokerage Charges

About TradePlus Online:

TradePlus Online is brokerage arm of Navia Markets, a well known Full service broker. Navia markets started their services in 1983 and became equity brokers with National Stock Exchange (NSE) in year 1995.

They got their own DP with NSDL n 1997 and MCX service was started in 2009.

TradePlus Online as on date has more than 40,000 clients and based out of Chennai. Even though they are discount brokers, they are not following the pricing model of other popular discount brokers like Zerodha.

They have unlimited trading plans for Rs99 per month, one of the lowest in the entire country.

Following segments are supported by them,

- Equities

- Currency

- Commodities

- Mutual Funds

- Bonds

- Insurance

- NRI trading

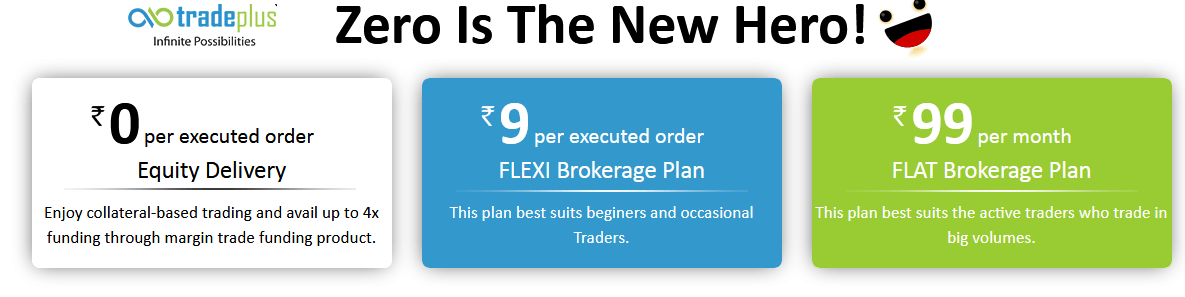

TradePlus Online Brokerage Charges:

As I said before, they have a uniqye brokerage model. For Currency, options, commodity and Futures, they have unlimited trading plans with fixed monthly charges.

Please look at below table to have more details,

| Segment | Brokerage Charges |

| Equity Delivery | Rs 0 |

| Equity Intraday | Rs 9/order |

| Equity Futures | Rs 9/order |

| Equity Options | Rs 9/order |

| Currency Futures | Rs 9/order |

| Currency Options | Rs 9/orderer |

| Commodity | Rs 9/order |

what I understand from them is, above monthly fees are refundable. That means if you don’t carry out a single trader in any particular month, then that month’s charges are refunded back to the account.

TradePlus Online Trading Platforms:

They offer various types of trading platforms to cater different categories of traders. Below are the details of the platforms offered by them,

INFINI Trader:

It is the executable softwared need to be installed in laptop or desktop. It is a power packed platforms with multiple features such as Charting, risk Management, view open positions and trader, condition market watch etc

INFINI Web:

It is a HTML5 based trading and analytic platform with many customizable workspaces.

Tradeplus Mobile App:

It is the mobile trading platform of Tradeplus. Best part of this app is, it allows clients to ask queries and resolution to them within the app.

One can also check ledger balance and open positions, profile view etc.

Apart from above platforms, they also offer third party trading platforms such as NEAT on Web (NOW – Powered by NSE).

And they also offer some other useful tools such as AHA – an analytical tool for intraday trading , and AMS- an unique alert management system for safe trading.

TradePlus Online Account Opening Charges:

- Trading Account Opening Charges : Rs 199 + Taxes

- Trading Account Annual Maintenance Charges : NIL

- Demat Account Opening Charges : NIL

- Demat Account Annual Maintenance Charges (AMC) : Rs 900 for 10 years OR Rs500 for 5 years (Plus taxes)

TradePlus Online Pros and Cons:

Disadvantages of Tradeplus Online:

- Very competitive brokerage plans

- No market recommendations and tips as they are discount brokers

- MAC version of NOW is not available

Advantages of Tradeplus Online:

- Very competitive brokerage plans

- Twitter based customer service is one of its kind in India

- One of its kind SMP where client can subscribe to different value packs

- PayTM integration for easy accessibility

- Refer customers and earn when they trade

TradePlus Online Review – Conclusion:

As on today, Tradeplus Online has major client base in south India , especially Tamil nadu. Their trading plans are unique and may take someone to get used to it. As most of the discount brokers have simple Rs20/ trade plan, Tradeplus has subscription pack based theme.

Keeping their brokerage plans , you can consider opening account with them if you are a frequent trader and want to save brokerage. For investors, I recommend not to choose them and select any one of the reputed brokers in your town/city.

You May Be Also Interested In: